"Fixer-Upper" or Money Pit? How to Spot the Difference Before You Buy

- TCS Hello

- Sep 10

- 8 min read

The dream of buying a fixer-upper is an enduring part of the American psyche. It's the promise of a blank canvas, a chance to build a home from the ground up, and a strategic path to homeownership at a lower price point. For many, it's an opportunity to build instant equity by investing their time and labor. Yet, this dream can quickly devolve into a nightmare. The line between a smart buy and a money pit is razor-thin, and it’s a line that many buyers cross without even realizing it.

A coat of new paint, a few modern light fixtures, or professional home staging can hide a multitude of sins. Even a standard home inspection, while essential, may not catch every hidden problem. This guide is designed to empower you with the knowledge and perspective needed to tell the difference, so you can move forward with a clear vision and a robust plan. We will delve into every aspect of the fixer-upper journey, from the initial assessment of your personal readiness to the granular details of spotting costly problems and executing a successful renovation.

1. The Definitive Difference: What "Fixer" Really Means

The term "fixer-upper" is so broadly used it has lost its true meaning. To make an informed decision, you must understand the critical distinctions between a cosmetic project, a major renovation, and a full-scale rebuild.

The True Fixer-Upper (The Cosmetic Project): This is the ideal scenario. A true fixer-upper is a home with solid bones. The foundation is stable, the roof is sound, and the main systems (plumbing, electrical, HVAC) are functional, even if they are older. The repairs are primarily superficial and involve things like updating a dated kitchen or bathroom, replacing worn flooring, or painting the entire interior and exterior. These are projects that can often be tackled one at a time and, in many cases, are a DIYer's dream. The home is livable during the renovation, allowing you to move in and work at your own pace, saving on temporary housing costs.

The Major Renovation: This type of property has more significant problems that go beyond aesthetics. It might have a leaky roof, outdated electrical systems that don't meet modern safety standards, or plumbing that needs to be replaced. While the core structure is still sound, the work is more invasive and costly. It almost always requires licensed professionals, building permits, and a larger budget. You may be able to live in the house during some of these projects, but others, like a full electrical rewire, might necessitate a temporary move.

The Money Pit (The Full Rebuild): This is the property you must avoid at all costs unless you are an experienced contractor or developer. These homes have major, systemic failures. This can mean a failing foundation, extensive water damage, widespread mold, or a compromised structure. The problems are not isolated; they are interconnected and will spiral into a complex, expensive, and time-consuming project. A full rebuild requires you to essentially tear the house down to its frame—or even tear it down completely—and start over. The cost, timeline, and stress associated with this level of work are astronomical and almost always exceed the property's potential value.

The key to distinguishing these categories is the scope and predictability of the work. A good fixer-upper has a clear path forward with visible, manageable problems. A money pit is a Pandora's box of hidden issues that will drain your resources with every discovery.

2. The Personal Reality Check: Are You Prepared for the Journey?

Before you even start looking at properties, you must be brutally honest with yourself. A fixer-upper isn't just a financial investment; it’s a commitment of your time, energy, and emotional well-being.

Assessing Your Financial Capacity

The most common mistake first-time fixer-upper buyers make is underestimating the true cost of the project. Your budget must account for more than just the purchase price.

Renovation Budget: Don't just pull a number out of thin air. Get detailed estimates for every project, from the cost of a new kitchen to a bathroom remodel. Research material costs and get quotes from local contractors. A kitchen remodel can range from $25,000 to $50,000, and a bathroom remodel can be $10,000 to $25,000, depending on the quality of materials and the scope of work.

The Contingency Fund: This is the most critical part of your budget. A contingency fund of at least 15-20% of your total renovation budget is a non-negotiable safety net. This buffer is for the inevitable surprises you will find behind the walls—things like discovering old knob-and-tube wiring, a hidden water leak, or termite damage. Without this cushion, one unexpected problem can derail your entire project and force you to go into debt.

Holding Costs: If the property is unlivable during construction, you must account for the financial burden of paying for both a mortgage on the new property and rent for temporary housing. These costs, along with property taxes and insurance, can add up to thousands of dollars a month, putting immense pressure on your timeline.

Renovation Loans: While financing options like the FHA 203(k) loan or the Fannie Mae HomeStyle Renovation loan can help, they are not a silver bullet. They come with strict rules, extensive paperwork, and often require multiple inspections and contractor bids. You must be prepared to manage a complex administrative process in addition to the renovation itself.

Understanding Your Timeline

Renovation projects almost always take longer than you anticipate. A simple bathroom update that should take two weeks can easily stretch to a month or more due to shipping delays, contractor scheduling conflicts, or unexpected permit requirements. If you have a firm deadline for moving in, a property requiring major renovations may not be for you. Be prepared to be flexible and to pay for extra months of rent if needed.

Gauging Your Emotional Resilience

Living through a renovation is not a glamorous television show; it's a marathon of dust, noise, and constant decision-making. Are you the kind of person who can stay calm when things go wrong? Can you handle the stress of unexpected bills and delays? A fixer-upper demands a high level of patience, problem-solving, and emotional fortitude. If surprises throw you off balance, it may be wiser to look for a home that is move-in ready.

3. The Ultimate Red Flags: Spotting a True Money Pit

While a home inspector will provide a professional assessment, you should also know what to look for yourself. These red flags are almost always a sign that the property is a money pit, not a fixer-upper.

Foundation and Structural Issues

The foundation is the most important part of any home. If it is compromised, it’s a sign to walk away. The costs to repair a foundation are astronomical and can spiral out of control.

Warning Signs: Look for large, zigzagging cracks in the foundation walls, sloping or uneven floors, doors and windows that stick or won't close, and cracked drywall or ceiling.

Cost Breakdown:

Underpinning: The most common repair for a sinking foundation involves installing steel or concrete piers deep into the ground. Each pier can cost between $1,000 and $3,000, and a home may need a dozen or more.

Wall Anchors: If basement walls are bowing inward due to soil pressure, contractors use steel plates or anchors to pull the wall back. This can cost anywhere from $4,000 to $12,000.

The Cascading Effect: A shifting foundation can cause a domino effect of damage to plumbing, electrical wiring, and the home's framing, adding thousands more to your repair bill.

Major System Failures

These are not isolated problems; they are systemic and will require a complete overhaul.

Plumbing: Look for signs of galvanized steel or cast iron pipes, which are common in older homes and are prone to corrosion and leaks. Replacing a home's entire plumbing system can cost between $3,000 and $16,000, which will also require opening walls and floors.

Electrical: If the home has knob-and-tube wiring (common in pre-1940s homes) or outdated aluminum wiring, a full rewire is often necessary for safety. This is a major project that can cost $10,000 to $20,000 or more, not including the cost to repair the drywall.

HVAC: Replacing an entire HVAC system can cost anywhere from $5,000 to $15,000, and a failing system could signal underlying issues with the home's insulation or ductwork.

Environmental Hazards

These are health risks that require professional, licensed remediation, which is always expensive.

Asbestos: Found in old insulation, flooring, and siding. Professional removal is required and can cost anywhere from $5 to $20 per square foot, with the total cost quickly running into the tens of thousands of dollars.

Lead Paint: Found in homes built before 1978. Lead abatement can involve professional encapsulation or removal, with costs ranging from $10,000 to $30,000 for a full house.

Mold: A sign of extensive water damage. Professional remediation is essential and can cost $10 to $25 per square foot, with large-scale projects easily exceeding $15,000.

Permit Violations and Unpermitted Work

Always check the property's permit history with the local city or county building department. Unpermitted work, such as a garage converted into a bedroom or an unapproved addition, can be a major legal and financial headache. You could be forced to tear down the unpermitted work or spend significant money to get it up to code.

4. The Path to a Smart Buy: A Step-by-Step Action Plan

Once you've found a property you love that doesn't have major red flags, you must follow a strict due diligence process to verify its potential.

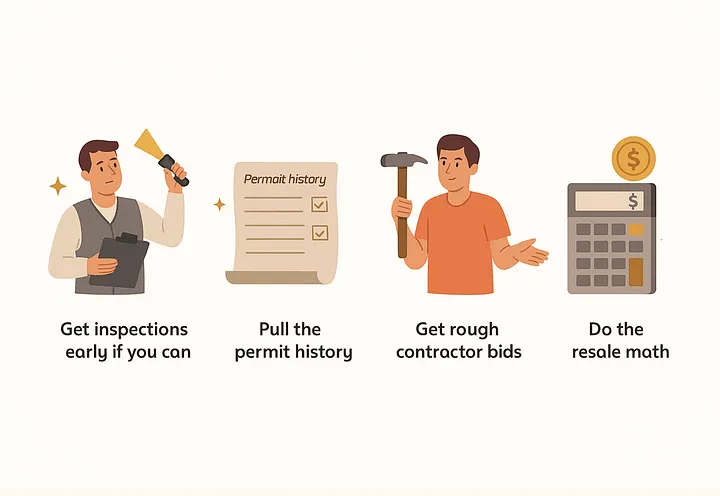

Get a Comprehensive Inspection: Hire a general home inspector, but don't stop there. If they flag any potential issues, hire specialists. A structural engineer for the foundation, a roofer for the roof, and an electrician for the wiring.

Bring a Contractor with You: Before you make an offer, bring a trusted general contractor on a walkthrough. They can provide a realistic estimate of the renovation costs and flag any potential problems you may have missed. Their professional opinion is invaluable.

Run the Numbers Again: Create a detailed financial model that includes every possible cost: purchase price, renovation costs, your contingency fund, and holding costs. Then, research the market value of fully renovated homes in the area. Your final number (purchase price + all costs) should be at least 15-20% below the post-renovation market value. This is your equity and your buffer against unexpected costs.

Secure Your Financing: If you are using a renovation loan, get pre-approved and understand the full process, including the paperwork, inspections, and contractor requirements.

5. When a Fixer Is a Smart Investment

A fixer-upper can be a fantastic deal when the conditions are right.

Strong Structure, Good Layout: If the home has solid bones and a functional layout, cosmetic updates are a manageable project. You can take your time updating finishes while living in the home.

Clear Scope, Predictable Costs: The best fixers have a clear, visible list of problems. You know exactly what needs to be fixed, in what order, and what it will cost. Predictability is the key to a successful renovation.

Strong Market: Buying a fixer-upper in a neighborhood with high demand and strong comparable sales ensures that your investment will pay off.

Final Thoughts: Buy the Right Kind of Trouble

The key to a successful fixer-upper project is not how good the house looks, but how well you understand the risks. Every fixer has problems; that’s the point. But the right ones have a clear path to resolution and an upside that is tangible, not hypothetical.

Be cautious, be curious, and be honest with yourself about what you can handle financially and emotionally. If the math works even with a significant contingency, and if you have a clear plan for the work that needs to be done, a fixer-upper can be a fantastic way to build equity and create a home you truly love. But if the risks are buried in a failing foundation, ancient systems, or unpermitted work, it’s a sign to walk away and find a project that won't bury you in debt and regret.

Comments